In the last 72 hours, the cryptocurrency market has been relatively stable at $111 billion as the Bitcoin price initiated no major movement.

Bitcoin has struggled to break out of key resistance levels or drop below crucial support levels, demonstrating a stalemate for well over three weeks.

Since January, Bitcoin has remained in a low range between $3,200 to $4,000, unable to engage in any meaningful short-term price movement.

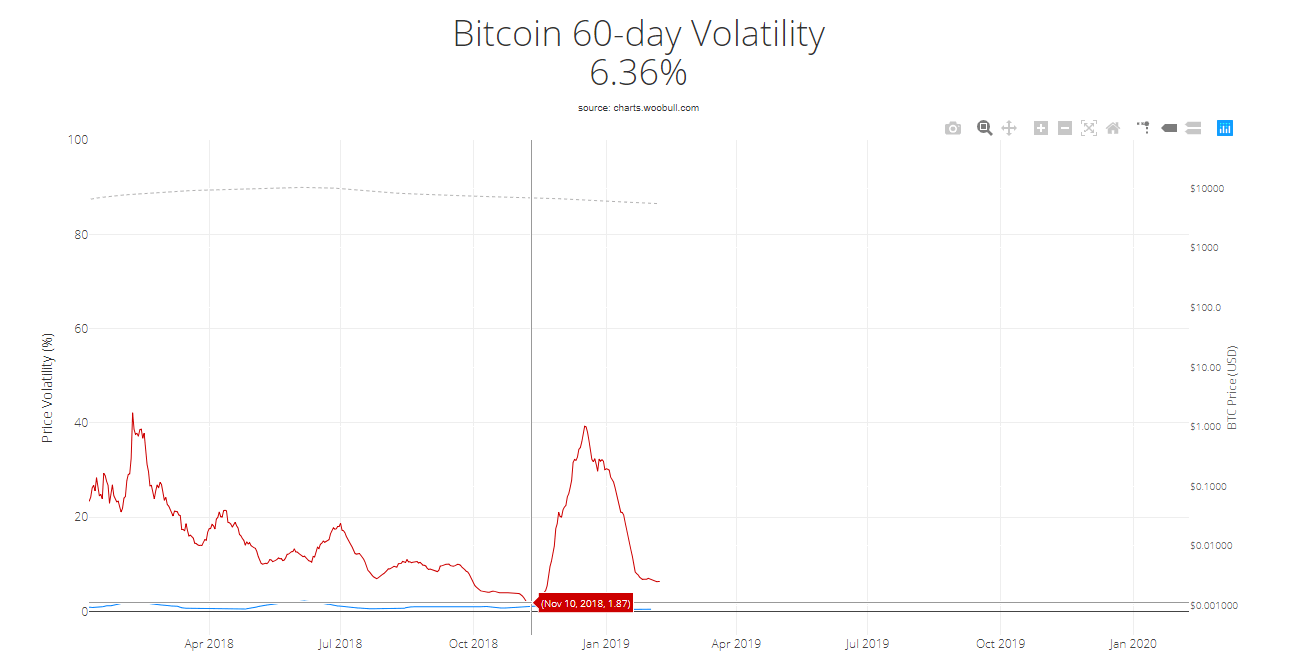

BITCOIN VOLATILITY DROPPING MAY MEAN BAD NEWS

The volatility of Bitcoin has dropped significantly since mid-January as the dominant cryptocurrency showed stability in a tight range in the low region of $3,000.

https://twitter.com/VentureCoinist/status/1093589001670410240/photo/1?ref_src=twsrc%5Etfw%7Ctwcamp%5Etweetembed%7Ctwterm%5E1093589001670410240&ref_url=https%3A%2F%2Fwww.ccn.com%2Fbitcoin-volatility-dying-btc-plunged-50-6500-free-fall

The last time the volatility of Bitcoin recorded a free fall was in November. Following a stable few weeks, the price of BTC went on to plunge from $6,500 to $3,122 within 1 month.

In a relatively short period of time, the price of BTC dropped by more than 51 percent.

Already, analysts have begun to lower their forecasts in the short-term performance of BTC.

Similarly, highly regarded cryptocurrency traders such as DonAlt and The Crypto Dog have said that Bitcoin is likely to fall to the low $2,000 region if it fails to recover beyond $4,000 in the foreseeable future.

But, although the next likely move for BTC is to demonstrate a lower level of momentum in the upcoming weeks, The Crypto Dog noted that it is still a risky period to short the asset.

“Shorting [Bitcoin at] 33XX is like shorting 63XX. Maybe the floor breaks on this go, or maybe you’re going to be wrong 5 times in a row. (Maybe it never breaks) Holding a short from higher up – yeah that’s perfectly reasonable.”

Hsaka, a cryptocurrency technical analyst, also suggested that it is difficult to short Bitcoin because it is defending the $3,300 support level with relative strength.

Emoticon